Aug 25, 2023 • Finance

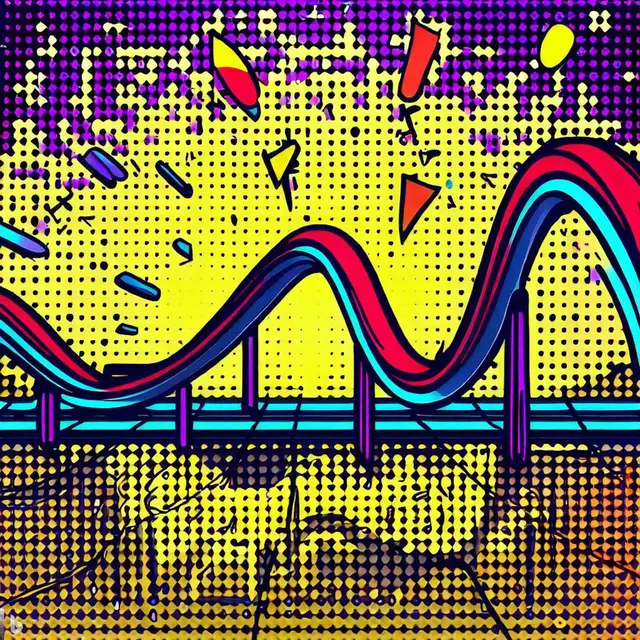

Riding the Hype-Cycle Roller Coaster

A Journey from Unicorns to Underwhelming Returns

Are you tired of steady, predictable returns on your investments? Ready to trade your snooze-worthy blue-chip stocks for a wild ride on the startup unicorn express? Well, gather around the campfire, fellow adrenaline-junkies, because we're about to embark on the roller coaster that is the hype-cycle.

1. What the Hype is the Hype-Cycle Anyway?

Imagine, if you will, a shiny new gizmo – perhaps a toaster that also makes coffee and live-tweets about it. This isn’t just any gizmo; it’s The Gizmo™, and everyone and their grandma are talking about it. Investment dollars are thrown around like confetti, and unicorns are dancing in the streets. Welcome to the Peak of Inflated Expectations.

However, it doesn’t take long before The Gizmo™ has a meltdown and tweets out some unsavoury words. Investors panic. Grandmas everywhere are disillusioned. This tragic fall from grace, dear readers, is the Trough of Disillusionment.

For some assets, there’s light at the end of the tunnel. The Gizmo™ may get a software update, learn some manners, and slowly become a household staple – this is the Slope of Enlightenment. Finally, we might reach the Plateau of Productivity where The Gizmo™ is just another blip in the crowded IoT marketplace.

2. Hype-Cycle in Numbers

Let’s get factual for a moment. We've seen unicorns (startups valued at over $1 billion) like Theranos reach valuations of $9 billion during the peak, only to crash spectacularly when their promises proved emptier than a politician's.

On the flip side, we've watched the likes of Amazon rise from the ashes of the dot-com bubble, morphing from an online bookstore caught in the trough, to today's e-commerce titan. If we had a dime for every company that rode this cycle, we’d probably have about... $8.4 trillion, which is, incidentally, the amount wiped off global stock markets during the 2008 crash (coincidence? Maybe not).

3. A Few (Mis)Adventures in Hype-Cycle Land

Bitconnect: Once touted as the next big thing in the crypto space, Bitconnect promised consistent daily returns. And while it skyrocketed to the Peak of Inflated Expectations with a market cap of over $2.6 billion, it descended swiftly into the Trough of Disillusionment when the world realized it was a Ponzi scheme. Oops.

3D TV: Remember when everyone thought 3D TVs would revolutionise our living rooms? Manufacturers and investors alike had dollar signs in their eyes. But by the time the Trough hit, those glasses weren't just 3D, they were rosy-tinted.

4. So, Why Do We Fall for the Hype-Cycle Every. Single. Time?

Humans, as it turns out, are eternal optimists – and a tad forgetful. We get a kick from the rush of a new investment opportunity, the dopamine hit of the 'next big thing'. Plus, there's always that tantalising hope: "What if this is the next Bitcoin and not the next Bitconnect?"

In Conclusion

The Hype-Cycle isn't just a curve; it's an emotional roller coaster for investors chasing the thrill. While we've taken a light-hearted look at it today, it serves as a vital reminder: do your homework, don't invest more than you can afford to lose, and always remember - if it looks too good to be true, it probably belongs somewhere on that roller coaster. Just hold onto your wallets (and your hats).